Preparing West Hollywood’s vulnerable apartment buildings for the disastrous impact of the next earthquake means that owners of hundreds of those buildings will have to find ways to finance costly safety measures, and residents of those buildings are likely to face rent increases to help cover those costs.

Figuring out how to make that happen was the subject of a discussion at a community meeting on Saturday organized by the city’s Rent Stabilization Division.

Saturday’s meeting is one of two (the next takes place on Tuesday at 6:30 p.m. at Plummer Park’s Fiesta Hall) designed to get feedback from building owners and residents about options under consideration by City Hall. City Hall will bring a proposal to WeHo’s Rent Stabilization Commission on March 8 for consideration. It then will present a proposal to the City Council in April. That presentation is likely to lead to further revision of the proposal before it is presented to the Council for a final vote.

The City Council in 2015 asked city staffers to review the city’s existing residential buildings and determine which might be at risk of collapse during the next major earthquake. The city hired Degenkolb Engineers, which identified 780 buildings that might be at risk. The city currently is taking a deeper look at each of those buildings to decide which of them might actually need some sort of retrofitting to protect it from collapse.

At-Risk Buildings

Those buildings generally fall into three categories — wood-frame buildings with soft or open-front walls, “non-ductile” concrete and “pre-Northridge steel moment frame” buildings, and wood-frame buildings with “cripple walls” and “sill plate anchorage.”

Last year the City Council voted to require owners of at risk wood-frame buildings with soft or open-front walls to hire an engineer to determine the risk and then hire a contractor to make the changes necessary to reduce the risk. Once the city has determined which buildings actually may be at risk, building owners will be notified and have five years to complete the retrofitting.

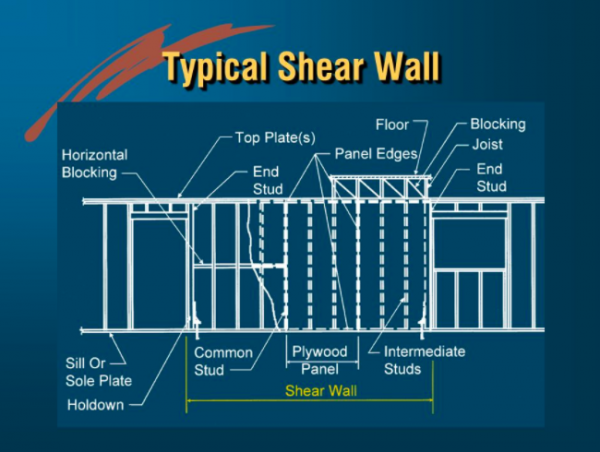

Such “soft story” buildings are those with “tuck under” parking, meaning they have a first floor parking area that can be entered from the street with the apartments constructed above that.

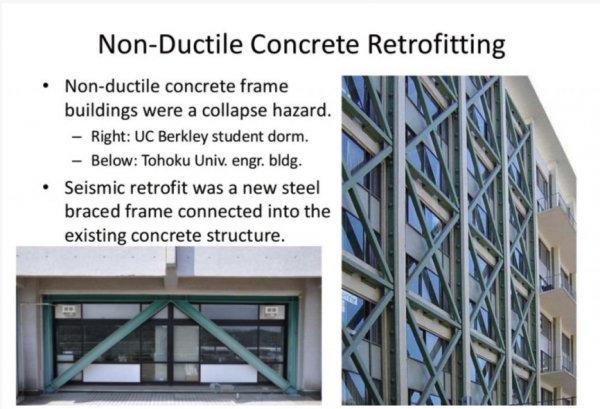

The Council also voted to require the same action by owners of at risk “non-ductile” concrete and “pre-Northridge steel moment frame” buildings. Owners of those buildings have the same five-year period to fix their buildings.

Such buildings typically are those with a roof and/or floor supported by a concrete wall or concrete column, constructed before January 1977. They have deficiencies in their lateral force-resisting system that makes them unable to sustain gravity loads during an earthquake

Owners of at-risk wood-frame buildings with “cripple walls” and “sill plate anchorage” are encouraged to retrofit them but the city doesn’t require it.

“Cripple walls” buildings are those with wood-framed stud walls extending from the top of the foundation wall to the underside of the lowest floor framing. “Sill plate anchorage” describes those buildings with a metal plate foundation that bears support between floor joists or

floor beams and the foundation.

Condo owners aren’t required to protect their buildings from earthquakes. Last June, the City Council yielded to demands by condo owners who cited the cost of such work, with a resident of the luxury Sierra Towers saying it could cost $600,000 to $1 million per unit.

Peter Noonan, the city’s Rent Stabilization Division manager, said the challenge is finding a way to balance the need of building owners to make a reasonable profit while helping tenants continue to afford their apartments.

Options for Calculating Tenant Rent Payments

Two options for paying for earthquake retrofits of rent-stabilized buildings were discussed at Saturday’s meeting:

—Net-Operating Income Increase. This would permit a rent increase in the event the annual cost of the retrofit, as calculated over a city-designated number of years, would reduce the building owner’s net operating income from the building to less than that of a particularly designated year. The city currently allows such rent increases if a building owner can document that he or she is making less profit than in the past because of improvements to the building.

That would mean an increase for some renters in what the city currently permits for rent-stabilized apartments, which is a maximum of 60% of the annual increase in the Consumer Price Index. This year’s maximum increase was 1.75%. The increase also would be permanent, meaning it would not end after the increase has generated enough additional revenue to cover the cost of the retrofit.

Saturday’s presentation offered an example of an owner of a ten-unit, rent-stabilized apartment building whose current income from the building is $85,000 a year. If that owner took a 30-year loan of $104,000 to retrofit the building at an interest rate of 8.5%, the owner would by paying $9,800 a year on that loan. However, the owner’s operating profit on the building would be only $78,000 a year, a reduction of $7,000 from profit in the designated previous year. To cover that cost, the owner would have to increase the rent on each of the 10 units by $23 a month.

—Cost Recovery Increase. This option is likely to be favored by tenants. It would allow the building owner to recover a designated percentage of the cost of the retrofitting over a period of time set by the city.

Using the example of the 10-unit building with a 30-year, $104,000 loan that requires a $9,800 annual payment, the monthly rent increase would be $82 if the city permits the landlord to pass through 100% of the cost of the loan over 30 years. However, if the city allowed the owner to pass along only 50% of the annual loan cost, the rent increase would be $41 a month.

The City Council would have the authority to decide whether the “cost recovery” rent increase would end at the end of the designated period or whether it would be permanently incorporated into a tenant’s rent.

The City of Los Angeles uses the cost recovery system It allows a building owner to pass through only 50% of the cost of retrofitting over a 10-year period. It also sets the maximum increase in the monthly rent at $38. And it factors that increase into the maximum allowable rent for rent-regulated apartment buildings. San Francisco also uses the cost recovery process. It allows the building owner to pass through 100% of the annual cost of a retrofit over 20 years, but limits the actual amount to no more than 10% of the monthly rent. That increase is not included in maximum allowable rent calculation.

What the City Council Will Have to Decide

Key questions the City Council eventually will have to answer are:

–Should West Hollywood have a rent increase policy or a cost recovery/cost pass-through policy?

–What percentage of the cost of the retrofit should the tenants have to pay?

–What period of time should the city establish (the amortization period) for calculating the annual costs of the retrofit?

–Should the city set a limit on the percentage or actual amount of the monthly rent increase?

–Should the increase in rent be included in or excluded from the maximum allowable rent set for each rent-stabilized apartment unit? And if it is included, should that be permanent?

–Should the city develop a program to exempt financially challenged residents from such rent increases?

This whole initiative is absolutely absurd. The number of people who have been killed in earthquakes in LA over the past 50 years is probably less than the number of people killed daily in car accidents. If you want to be completely safe from earthquakes, move out of CA.

We haven’t had a major earthquake in 24 years, of the 50 years you mentioned. Scientists predict a major earthquake to happen, which might be larger than anything we’ve seen in California in a very long time (since before the United States existed).

Also, this isn’t just about saving lives. It is about saving properties. Property damage after a major earthquake will put a major burden on our economy.

Is there a way to see the list of at-risk buildings and find out if I live in one? I looked through the page at weho.org and there’s nothing I can see…

@Andrew. WEHOville has requested the addresses of the buildings tentatively deemed to be at risk. However, City Hall has said it wants to do a more detailed review of those buildings to determine which one are really at risk before releasing the list. At that point WEHOville will publish it. We are on it!

The LA Times released a list: http://graphics.latimes.com/soft-story-apartments-needing-retrofit/

Yes. However, those are not in West Hollywood. The fact that the city hasn’t released such a list is probably a factor in the low turnout for the community meetings on this subject, one of which will be held tonight

“This could also be the underhanded way the City ends Rent Control by driving up the cost of these rents to get tenants out of the buildings for the landlords.”

This is an absolutely absurd statement. This suggestion is unfounded and contradicts the City’s policy decisions past and present.

Agreed. I think they are just trying to look at it from both sides, and their intention is to make buildings safer.

Tenants in rent control buildings deserve to be protected from the hazards of an earthquake and the damage that can be done if their building has not been properly maintained or retrofit. My issues with the increase in rent and tenant pass through fees are as follows: when you have a slumlord that does not make any other repairs on the apartment units, seizing an opportunity to raise the rent for the retrofit and the tenant is forced to pay this higher rate permantly or even for a temporary period of time – is this really fair? The tenant is… Read more »

Do you rent from Monem Corp by any chance?

@Pat – I do not but they could be partners with the owners of my building.

@Josh Kurpies – Call it absurd. Stranger things have happened. This is not a tenant friendly city. It’s a property owner city.

You make a point about tenants not getting any ownership in the real estate, and it might seem unfair, but imagine a scenario where a landlord has 80% rent-controlled units with long-term tenants. The landlord wouldn’t be able to increase his or her income, yet his or her costs might suddenly go up substantially.

I do not believe the city is trying to drive up rent for tenants. I think they are looking for solutions that make the buildings safer for everyone and are trying to look at it from both sides.

Please explain to me why condo OWNERS get a pass on these costs and renters do not. Imagine a scenario where your landlord is a slumlord as mine is and has let the property deteriorate in every way possible, and even cheat renters out of their security deposits. Then imagine a scenario where you go to the City for a rent reduction hearing and you get the One and Only One hearing examiner they have who is in my opinion, out of control, drunk on power, bias, inconsistent, makes written statements in her decision that go way beyond her authority… Read more »

I’m sorry, but the property owners should be responsible for 100% of the bill. This is just part of the pitfalls when owning a property and keeping it up to code & safe for tenants.

Totally agree with you.

No way. Especially if they are getting very low rent. No it’s part of the cost of living…and they should pay.

A well written, thorough presentation of the challenges of these necessary improvements.